how to avoid paying nanny tax

Make it official Apply for an Employment Identification Number EIN with the IRS. Yes you have spent.

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

He died alone and in debt at a cheap hotel in New York City.

. To break this down further you and your employee are each responsible for. Get answers to all your nanny tax questions. If your employee files a tax return with wages from your employment and you havent provided a W-2 to the employee you will have to pay the taxes and the IRS will fine and penalize you.

Get An EIN Number You can apply for an EIN directly through the IRS website. President from Clinton to Trump. Historic vehicles made before 1973.

If your employer pays more than 1000 in any quarter of the current year or the previous year to their household employees collectively theyre responsible for paying the 6. To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes. Although they do not have to pay the taxes before the due date of their return.

Want to know how people who pay domestic helpers under the table get caught for dodging the IRS. We deliver hundreds of new memes daily and much more humor. By paying nanny taxes an employer running a business can avoid legal notice.

It builds a good relationship between the employer and household employees. You can do this either by withholding. These taxes are collectively known as FICA and must be withheld from your nannys.

10 Tips On How To Avoid Paying Taxes Tip 1. Disabled car owners do not have to pay sales tax. But a better idea to avoid underpayment penalties or getting socked with a bigger-than-expected tax bill is to pay the IRS its due throughout the year.

Meet the employment tax obligations As an. Paying or Avoiding the Nanny Tax By Sue Shellenbarger. There are several exemptions for car sales tax including.

File a tax return as soon as possible after receiving the settlement. The unemployment tax is 62 percent of your employees FUTA. 4284 points 355 comments - Your daily dose of funny memes reaction meme pictures GIFs and videos.

If an employer hires them to. Heres how to pay a nanny in ten easy steps. You generally must pay unemployment tax on the first 7000 of wages you pay each household employee.

Withhold Social Security and Medicare taxes from your nannys pay each pay period. Call Monday - Friday 830 am - 8 pm Eastern Call 800-929-9213 5 Calculating What You Owe in Nanny Taxes Using a nanny tax calculator will. Vehicles used for agriculture or forestry.

Household employers pay the withheld taxes along with their own income taxes due by April 15. Mandatory Tax Forms Form W-2 You must provide your household. Become a Business Savant Its no secret that businesses have the most leverage when it comes to tax credits tax deductions or.

The EIN will be used in your future nanny tax dealings. The online application is quick and easy. Because the cost of the pension payment is tax deductible so paying 20000 into a pension might save you 3800 in corporation tax 20000 x 19.

The Social Security Administration requires you to file Form W-3 and. Nikolas Tesla died from coronary thrombosis. Nanny taxes are relatively simple to calculate.

This ongoing parade of Nannygate. Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return.

They run for office. Otherwise if the settlement is tax-free it may be possible to deduct the money from your taxes. FICA taxes are 153 of the employees wages.

5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes.

Household Help Could Mean More Tax Work For Employers Don T Mess With Taxes

Do I Have To Pay A Nanny Tax The Motley Fool

Nanny Payroll Services For Households Adp

Nanny Tax Do I Have To Pay It Credit Karma

/IsItOKToPayMyNannyinCash-4d00db8cf26f4f7a99abbfa0670e8ce5.jpg)

Is It Ok To Pay My Nanny In Cash

Nanny Tax Definition Why And How To Pay Nanny Taxes

We Hired A Nanny Now What About The Taxes Accredited Investors

5 Easy Ways To Reduce Your Nanny Taxes

How To Avoid Nanny Payroll Tax Trouble Surepayroll

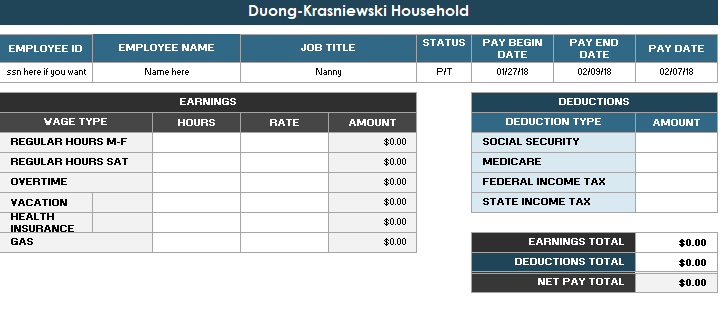

Nanny Taxes 2018 For Nc Specifically Baking And Math

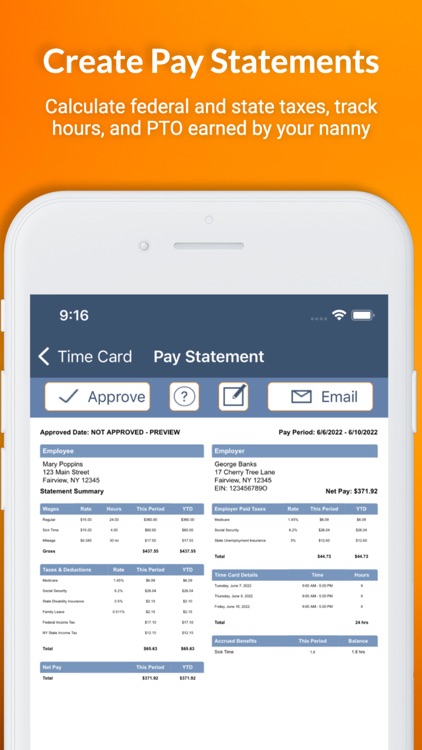

Paycheck Nanny By Michelle Grady

Tax Tips The Nanny Tax Not Just For Nannies Organized Instincts

Opinion Paying Nanny Taxes Is A Nightmare And Intuit Isn T Helping Deseret News

How To Avoid The Nanny Tax Maid Service Faqs

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Avoiding Nanny Tax Can Come Back To Cost You More

Paying Your Nanny Legally In Texas The First Milestones